Capital Gains Tax For 2025. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level. What you pay it on.

The rate of capital gains tax is 10%, where the total taxable gains and income is less than £37,700. Instead of trying to cash in on investments and paying taxes on them.

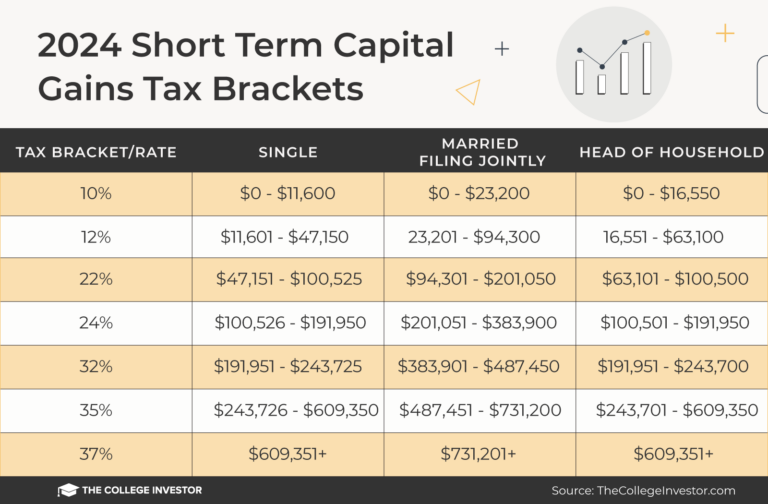

Tax Resource And Help Center The College Investor, Irs has announce new capital gains tax brackets for 2025. Basically, when most assets are sold for a profit, a.

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Published on december 5th, 2025.

Capital Gains Tax Brackets For 2025 And 2025, Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. What is the capital gains tax?

The Difference Between ShortTerm and Long Term Capital Gains, Published on december 5th, 2025. Gifts to your spouse or charity.

2025 Va Tax Brackets Latest News Update, The rate of capital gains tax is 10%, where the total taxable gains and income is less than £37,700. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, What are the capital gains tax rates for 2025? For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

Capital Gains on Share Transfer Rate & Eligibility IndiaFilings, High income earners may be subject to an additional. Reporting and paying capital gains tax.

Capital gains tax (India) simplified Read this if you invest in stocks, Enter values as estimated for the financial year ending on 31st march 2025. Add entry of capital gains or long term capital gain or short term capital gain via selling of assets, trading activity.

The Best To Live A Great Life, Any excess gains are taxed at 20%. Gifts to your spouse or charity.

Understanding the Capital Gains Tax A Case Study, The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Last updated 6 march 2025.